Terratico

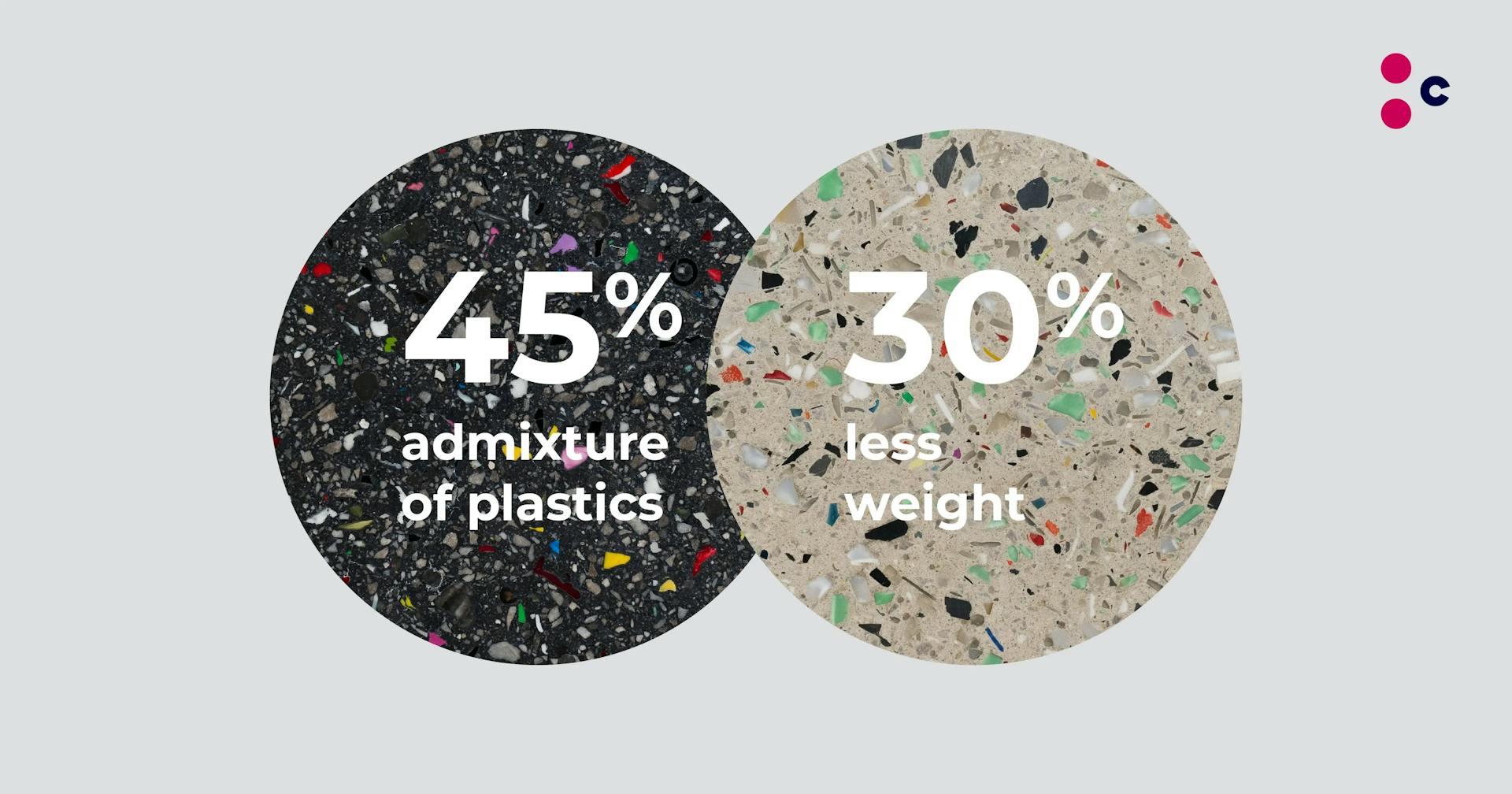

Terratico is the only company in the world that can incorporate up to 45% of plastic into the concrete mix using its patented production process. The resulting innovative building material represents an ecological alternative to tiles, large-format slabs and facades made of concrete or terrazzo.

The company currently needs investment to launch large-scale production, as their current small-scale production cannot flexibly satisfy the high demand from large customers. The capital will also allow for streamlining production costs and selling production licenses on other continents.

Unique properties of the material:

- 30% less weight than concrete

- Higher strength and crack resistance

- Minimum reinforcement requirement

- Certified for use with food

- Ecological benefit from using plastic in the mixture (ESG)

Why invest?

- Expected return of 3x the investment and more.

- Local production ensured by our own patented technology.

- Gross margin of around 70% and EBITDA margin up to 45%.

- Planned increase in sales revenue to €22+ million in 2027.

- A versatile team with experience in construction and finance.

- Standard investor protections plus 1.5x liquidity preference with an inflation clause secured by intellectual property rights and 2x dividend.

- Growing market for precast concrete and terrazzo at 5.2% pa.

- Non-existent competition in the use of plastics in the final mixture.

- Co-investor of Venture to Future Fund will provide the same amount to Terratico as Crowdberry investors, so you will be investing alongside an experienced partner.

Investment intention

About the company

Terratico was created based on the Nagy father-and-son team’s more than 25 years of experience and work in the field of building materials and their efforts to solve the general problem of excess plastic waste. The idea to use plastic recyclates in concrete as a substitute for crushed marble in terrazzo first came about in 2019. After two years of testing, the pilot version of the product was created, which the company has since been continuously improving.

The company achieved its first commercial success in 2021, when it produced 100 benches for a Slovak bank. Later, the company presented itself at major exhibitions, such as the Expo in Dubai and World of Concrete in Las Vegas, where it attracted significant international interest. (For more information about the company, see the Terratico (IoI) document).

Product

Technology

Entering the US market

Team

The investment carries the risk of partial or complete loss of invested funds. The investment opportunity in the target company is made possible by Crowdberry Investment Platform j.s.a.