KLM Nitra

Investment opportunity in a newly constructed logistics building (use approval in 2019) with a 10-year lease agreement to Slovak Parcel Service (SPS), a provider of express parcel services. The building has a leasable area of ca. 1,200 m2 and is located in close proximity to the Metro and Sconto retail stores, the Jaguar Land Rover car manufacturing plant and Nitra-Sever Industrial Park.

KLM real estate (KLM) has 17 years of experience in real estate development, with a strong team in place and an impressive portfolio of 33 completed projects with renowned partners.

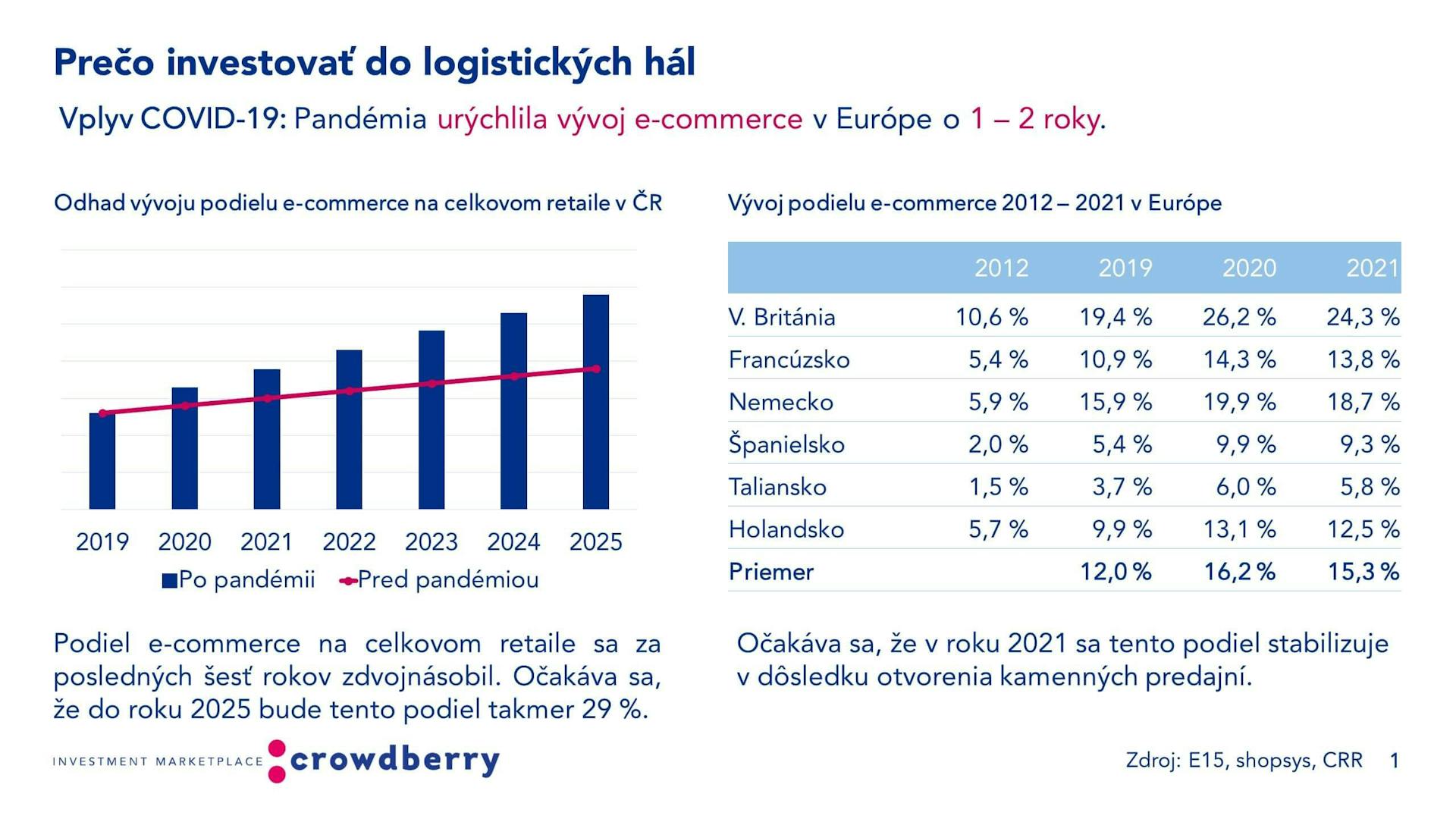

- The investment opportunity allows you to take advantage in the unprecedented growth in both e-commerce and delivery service sectors, which has led to an increased need for logistics space.

- Opportunity to become a co-owner of an income producing property.

- 10-year lease agreement signed with SPS, an established company that is part of Österreichische Post (Austria Post) that operates in 10 countries with an annual turnover of more than €2 billion and profits in excess of €144 million.

- Inflation protection: rent will be increased by inflation each year.

- The property is located close to the R1 expressway exit and only 5 km from Nitra city centre.

- Construction of the building was carried out by HSF, an experienced construction company, and finance was provided by Tatra Banka a.s.

Show your interest to invest to gain access to the „Information on Investment“ document including: detailed information on the investment, its location, financial parameters, investment structure and schedule, KLM real estate company profile and analysis of the market and competitive environment.

If you missed the opportunity to invest in KLM Nitra and would like to find out more about upcoming real estate projects, please contact our team realestate@crowdberry.eu

MARKET

To view this section, please register.

PARTNER

To view this section, please register.

PROJECT

To view this section, please register.

KLM in the media

To view this section, please register.