Comparative advantages of altFINS and current market situation

04/11/2022

The altFINS platform offers a complete investment and workflow experience with a focus on digital asset due diligence. It aims to enable investors to easily find and execute profitable trading operations on exchanges. It serves active – both individual and institutional – investors who want to make more informed decisions.

For its contribution to transparency and expertise in the still under-explored field of cryptoassets, altFINS was awarded the Seal of Excellence in 2020 and also a grant from the European Innovation Council – EIC¹.

The platform was founded by Richard Fetyko based on his own frustration with the lack of quality tools to find trading opportunities, create alerts, execute trading strategies and monitor the performance of a portfolio composed of digital assets across exchanges. Richard previously worked for 14 years on Wall Street in New York City in internet technology and media research and development at several investment banks such as Janney Montgomery Scott.

Upon returning to Slovakia, he decided to bring his financial, analytical and business experience to the cryptoasset market. During his career, he has been ranked as one of the best analysts several times in various rankings: the StarMine Analyst Awards (2nd place)², The Wall Street Journal Best on the Street (2nd and 4th place)³. In 2022, he became an exclusive contributor of articles to the Seeking Alpha platform⁴.

altFINS provides its registered users with:

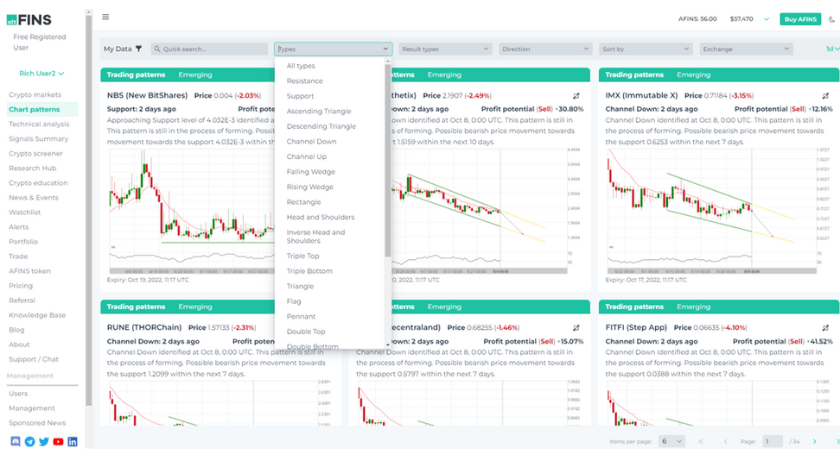

- automated trading chart pattern recognition – identify 16 common patterns in a chart based on AI, including predictions;

- curated charts – technical analysis of top cryptocurrencies using 5 key indicators: trend, momentum, pattern, volume, support and resistance;

- crypto market screener – analysis of more than 2,800 coins and over 6,000 pairs of coins based on a combination of 120 technical indicators;

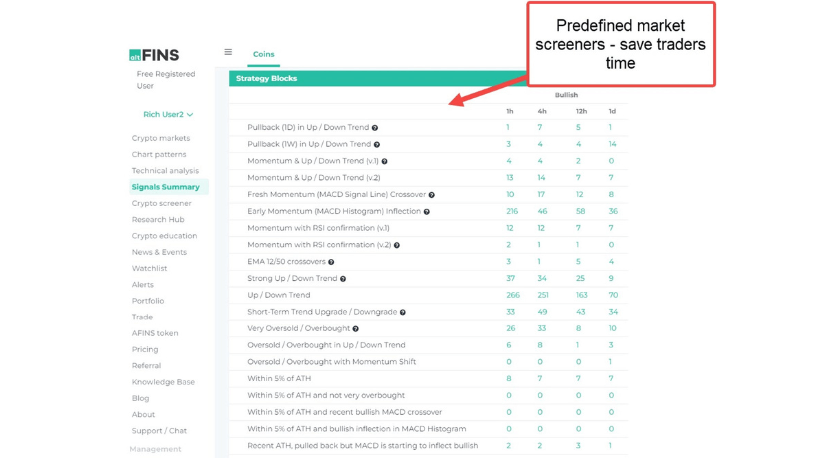

- pre-defined market screens – easy-to-get information on whether a cryptocurrency is in an uptrend, momentum or out of the default range;

- coin specific research reports – fundamental data on a given cryptocurrency, long-term investment analysis of cryptocurrencies, major trends, events;

- trading education – a series of 10 webinars teaching 7 trading strategies.

How to regard current market dynamics?

The current situation is not very favourable for the financial markets and the market for alternative forms of financing. Every day we see crashes and red numbers in the charts, with the market capitalization of cryptocurrencies dropping from $3 trillion at the end of 2021 to $1 trillion in the summer of 2022. However, altFINS sees this period as an opportunity. An opportunity to cleanse the market of projects that stand on no real foundation.

"Financial markets need to be viewed comprehensively, in the long term and with hindsight. Every crisis in the past has brought lessons, new more sophisticated products and pushed aside some of the speculators bending the market."

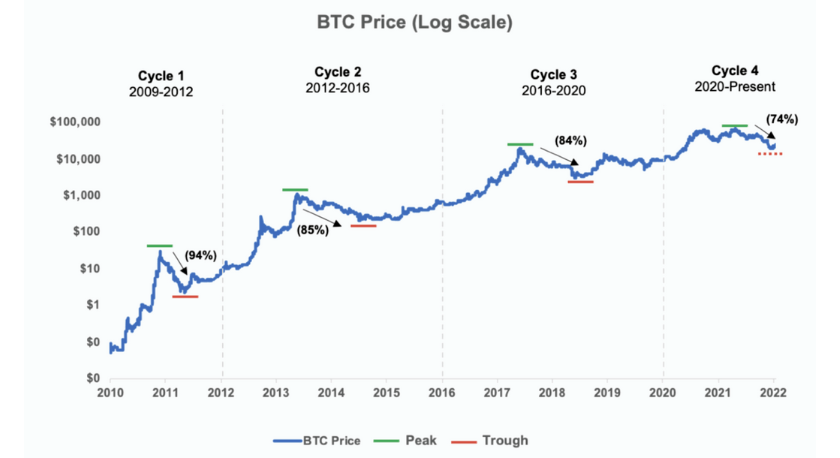

The most convenient way to look at the price of financial instruments over a long period of time is through logarithms. The traditional linear view mischaracterizes growth, since such growth in Bitcoin follows the same patterns of rapid growth adaptation that we have seen in networked technologies in the past, such as the Internet. This requires the use of logarithmic visualization in order to analyse percentage changes in price rather than absolute movements. Only through logarithmic optics can we reveal the bigger picture.

In the early years of Bitcoin's existence, its holders experienced the greatest volatility, as shown by the significant percentage movements in 2011, 2013-2014 and 2018-2019. Nevertheless, we can see that an investor who bought this digital asset just before one of its price declines during the extreme peaks in 2011, 2014 or 2017 would still be in a positive position on their investment. Compared to these historical price movements, the recent fluctuations are relatively small. Thus, periods of short-term volatility are not as significant for the long-term investor as they are for the short-term trader.

Investor interest persists

Blockchain technologies belong to the 21st century, as evidenced by the growing investment in these projects. In 2021, they reached $32.1 billion⁵, an increase of more than 480% year-on-year. The cryptoassets market has admittedly fallen significantly since mid-Q1 2022 due to the war in Ukraine, rising inflation and the problems experienced by the Terra crypto ecosystem. Nevertheless, investment in the first half of the year remained well above all years prior to 2021, at $14.2 billion⁶.

The largest deals in the first half of the year were made by venture capital investors, who put $550 million into Fireblocks, a company providing digital asset custody infrastructure, $450 million into ConsenSy, a company building infrastructure for Ethereum, and $400 million into crypto exchange FTX.

"An interesting transaction also took place this summer when crypto-analytics platform Messari raised a $35 million investment based on the company's $300 million valuation⁷, which only further solidifies altFINS' market potential and also investors in the multiple return of their investment."

Central banks are also heavily involved in cryptocurrencies. They are reflecting on the market, gradually introducing regulations in different countries at different levels, and at the same time research and development is underway on the introduction of national digital forms of currency (CBDC)⁸ – for example, a digital form of the euro. In Sweden, a pilot project has even been launched in 2021 in cooperation with the Swedish Riksbank, the so-called e-Krona token⁹, where the main motivation is the increasing digitization and further reduction of hard-to-trace cash transactions. All these steps contribute to the increased trustworthiness of these systems.

altFINS – A ‘Bloomberg’ for alternative investors interested in digital assets

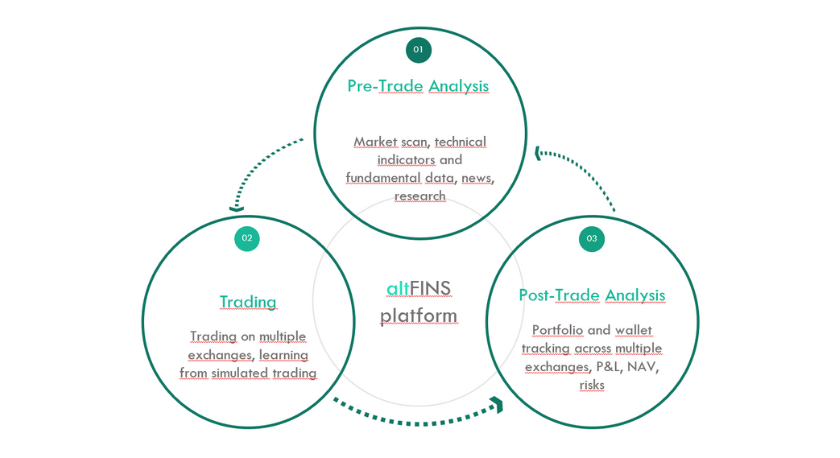

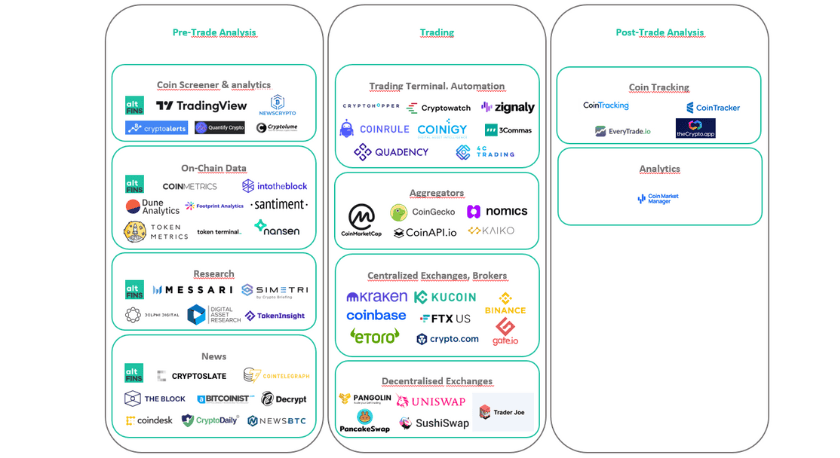

The altFINS platform seeks to bring efficiency to the digital asset investment process by covering the entire workflow from initial analysis through trade execution to post-investment monitoring of the portfolio. Most competitors focus largely on trade execution, but tend to neglect the analysis in the pre-trade phase, which is key to answering the question: "Which digital asset should I own, why, and when?"

altFINS covers complete pre-trade analysis (screening and analysis, on-chain data, research, news) and unlike its biggest competitor TradingView offers:

- easier orientation in the analysis results, filter settings and specification of the list of predefined filters;

- automated detection of patterns in the chart;

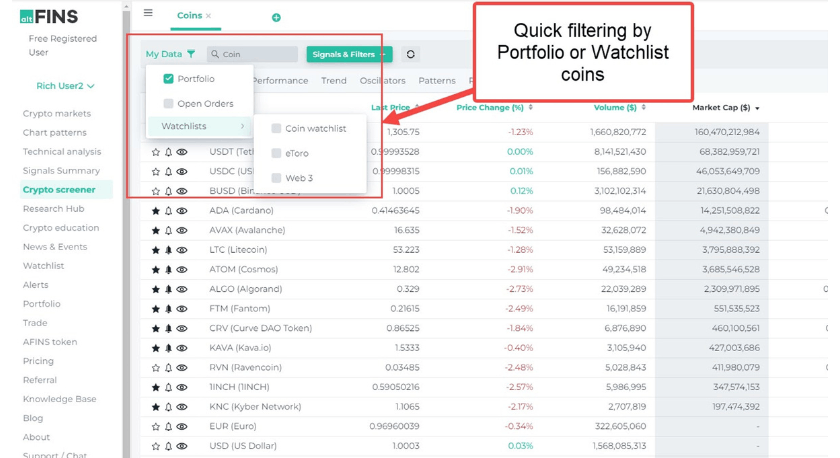

- filtering of screening results by the list of monitored entities by portfolio;

- predefined filters;

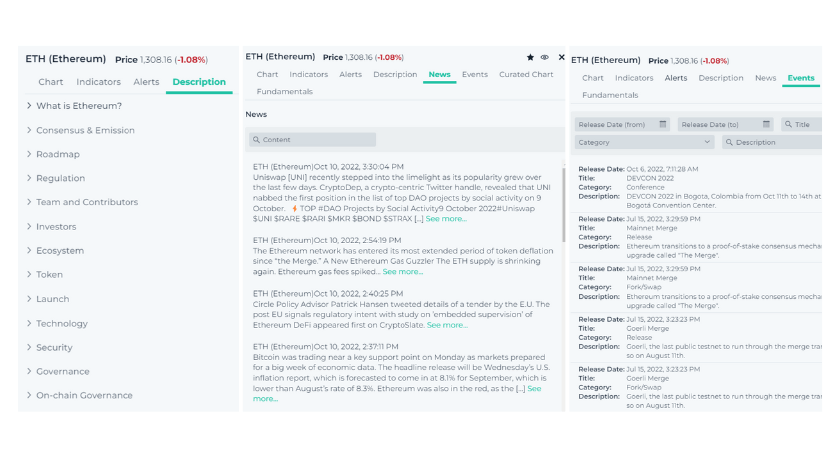

- extensive description of cryptocurrencies, news, events;

- fundamental data;

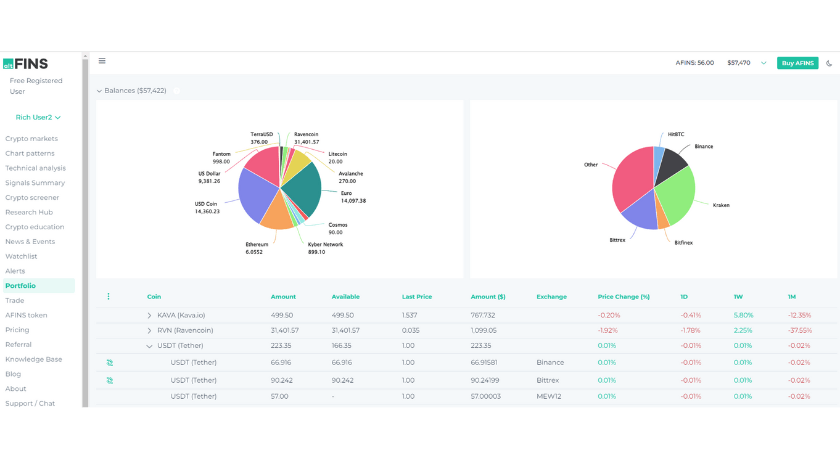

- portfolio aggregation across exchanges;

- proprietary analysis, research, blogs¹⁰ – cryptocurrencies, market, etc.

Finally, a few of the unique features that differentiate the altFINS platform from the rest

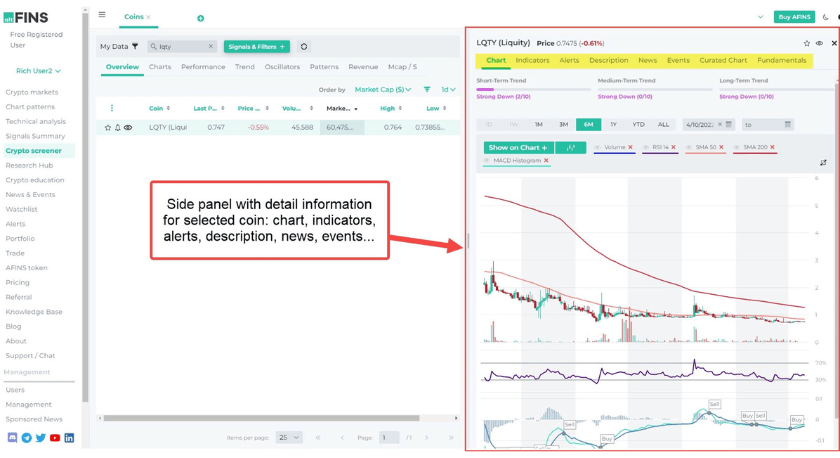

1. When selecting a cryptocurrency, the user is presented with a sidebar with detailed information about the cryptocurrency, whether a basic description, a chart of the price development, traded volume with default indicators, or simply market news.

2. The platform allows for formation analysis – the detection of specific patterns of technical analysis in the chart, which can provide the investor with information regarding the prediction of future price development. Examples of such patterns in a chart include: head and shoulders, inverted head and shoulders, double top, double bottom or triangle, flag and rectangle formations.

3. The user can easily filter between the cryptocurrencies in their portfolio and also between the coins they are interested in.

4. altFINS enables using a number of predefined trading signals, and at the same time each user can set their own predefined screeners, using combinations of technical indicators (SMA, EMA, RSI, MACD, ...) and variables such as market capitalization, traded volume and price development.

5. The platform provides a comprehensive picture of a given cryptoasset. The investor can view the project description, history, technology used, team expertise, future plans and so on. It also acts as an information portal, where the user learns about market news as well as important events and happenings.

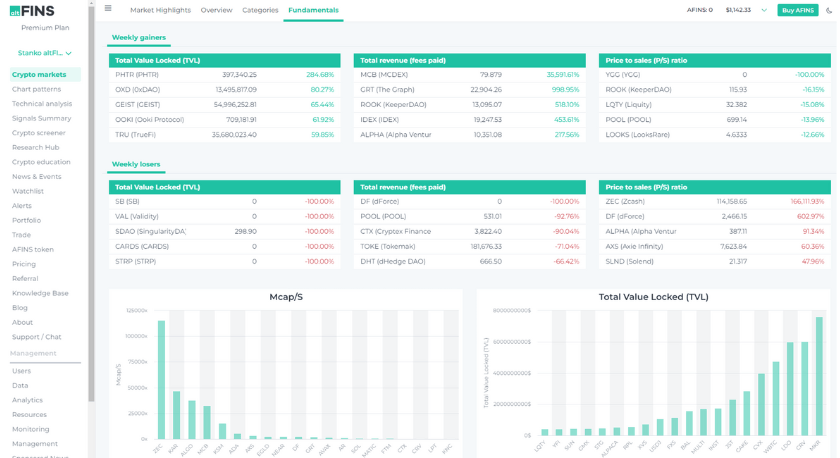

6. Additional features are continuously being added to the platform, especially with regard to fundamental data. These include, for example, the amount of revenue, the P/S ratio¹¹, the Total Value Locked¹², which has become a basic metric for investors and reveals much about the health of a given protocol. The higher the TVL, the more capital a cryptocurrency has to secure credit or provide liquidity, which increases both its usability and investor confidence.

7. Through the altFINS platform, the user can track the development of his portfolio across exchanges and cryptocurrencies even after the trade has been executed.

But the best way to evaluate the platform is to try it yourself. Registration is free, and altFINS has offered our registered investors the opportunity to test all of its functionalities, along with an available series of free educational webinars for a month.

Interested in AltFINS? Get in touch with an expert.

Natálie Jašková, Investment Manager

Telephone: +421 907 795 808

Email: Natalia.jaskova@crowdberry.eu

¹ https://innonews.blog/2020/08/18/liga-vynimocnych-15-spickovych-slovenskych-inovacnych-firiem-s-certifikatom-europskej-komisie/

² https://www.prnewswire.com/news-releases/merriman-curhan-ford-analyst-richard-fetyko-receives-2010-ft---starmine-analyst-award-for-the-internet-software--services-industry-93925159.html

³ https://www.wsj.com/public/resources/documents/best2007-stocks.htm

⁴ https://seekingalpha.com/author/richard-fetyko

⁵ Report KPMG Pulse of Fintech H2 2021

⁶ Report KPMG Pulse of Fintech H1 2022

⁷ https://www.theblock.co/post/162306/crypto-analytics-platform-messari-plots-raise-at-300-million-valuation/

⁸ https://www.atlanticcouncil.org/cbdctracker/

⁹ https://www.riksbank.se/globalassets/media/rapporter/e-krona/2022/e-krona-pilot-phase-2.pdf

¹⁰ https://altfins.com/blog/

¹¹ Poměr ceny k tržbám (P/S) – poměr tržní kapitalizace k tržbám

¹² Celková uzamčená hodnota (TVL) – hodnota kryptoaktiv uložená v protokolu