Good times to invest? They are here and now!

05/05/2023

Be part of an investment opportunity that is unique in the market for its exclusivity and functionality.

The Dobré časy (the Good Times) investment opportunity brings together segments that you would rarely get to participate in without an established partner: a healthcare facility, a value-added real estate project, and the untapped segments of long-term care and senior housing.

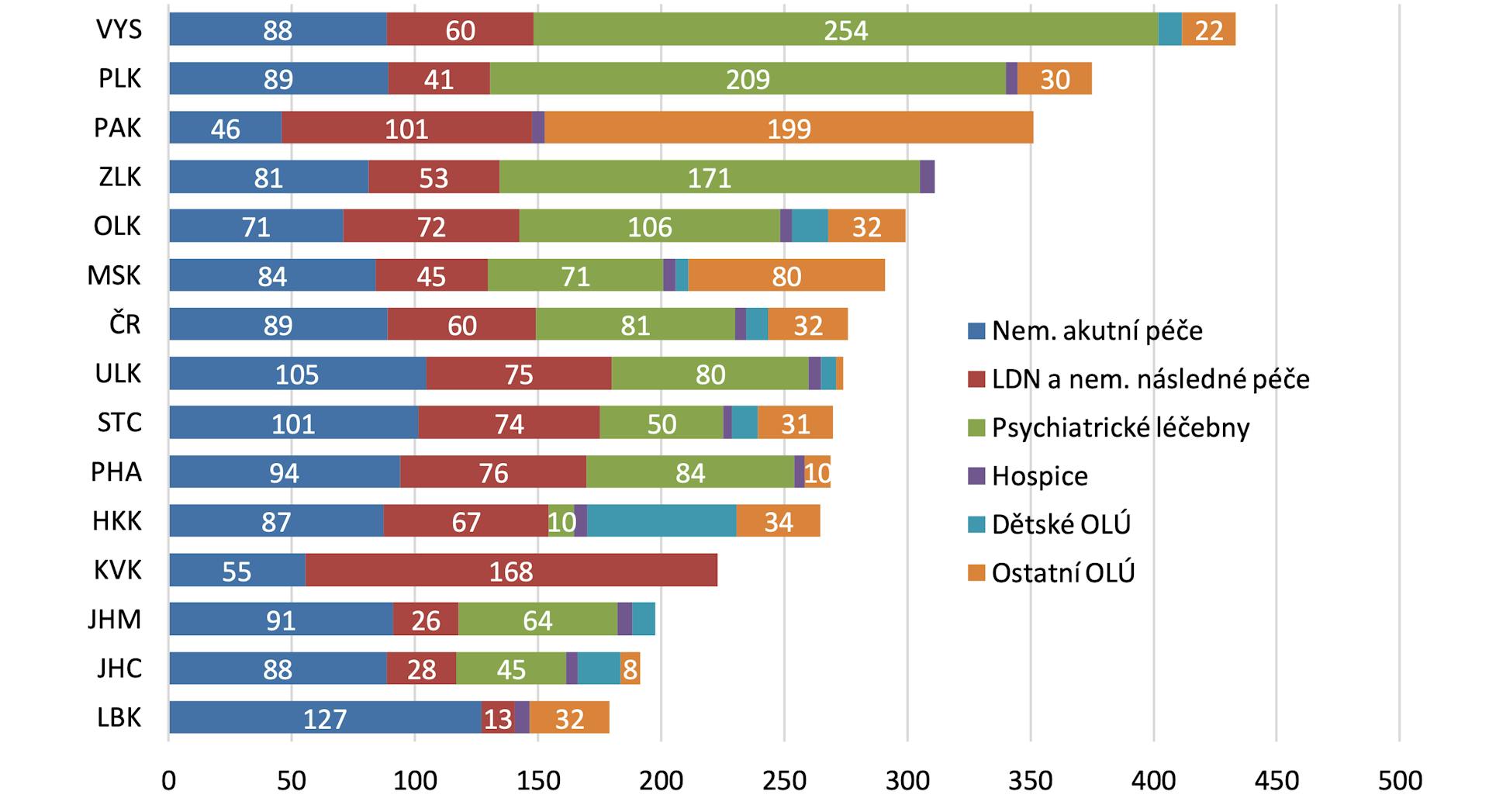

The demographics in Slovakia and the Czech Republic speak the same language – ageing populations. This is following a trend prevalent across Europe that is bringing with it problems in terms of a limited capacity in homes for the elderly and the even more significant problem of a lack of long-term care beds. The state is building only a minimal number of these facilities, meaning there is room and a need for the private sector to become more involved.

The investment plan for the Dobré časy facility reflects the lack of capacity in both segments in one of the most affected parts of the Czech Republic, namely the South Moravian region around Brno. The facility covers that rising demand, but also takes advantage of the situation in commercial real estate as well as providing a real estate investment with a growth strategy. The facility differs significantly from what is found in the standard senior care housing sector, which experienced income fluctuations as a result of the Covid-19 pandemic, in that client income was limited for most of the pandemic period.

The facility has a balanced mix of a 90-bed medical facility, which is fully funded and reimbursed through health insurance, and a 77-bed specialized home for seniors with special needs who require continuous assistance. There are even fewer of these centres on the market than standard homes for the elderly.

In terms of location, the facility is within 80 kilometres of 15 hospitals and significantly increases the capacity for the South Moravian Region, where there are currently only about 600 long-term inpatient care beds.

The Dobré časy facility offers a solution to the shortage of long-term care beds and sets a new standard for care services at a European level, while also representing a real estate project in an area that is becoming ever more attractive over the past decade.

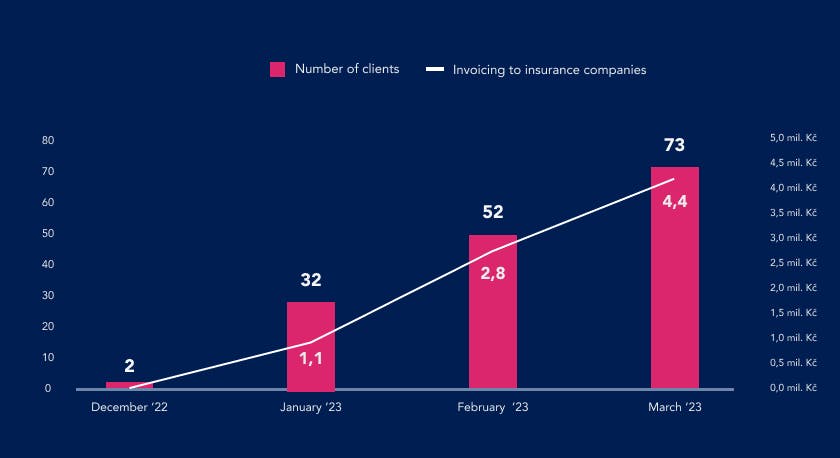

The already built and operating long-term inpatient care facility with a specialized care home is unique primarily because of the range of above-standard services it offers as well as the unprecedented interest due to the significant shortage of long-term care beds in the South Moravian Region. Within the first three months of operation, the facility had 73 satisfied clients and is also becoming a unique commercial real estate project.

The growth rate of new clients is supporting the expansion of bed capacity, which will increase revenue further.

About the investment opportunity

The current conditions for investors are the same as those for investment prior to the opening of the centre. The investment funds will help the facility expand capacity and the service options it plans to provide to clients.

In addition, “Crowdberry has been able to negotiate with other partners for priority payment of the proceeds of any sale to investors. This means that Crowdberry's investors will be paid a preferential return on investment of up to 10% per annum," says Viliam Perát of Crowdberry.

This combination creates a unique opportunity for investors looking to increase the value of their assets in a sector that combines real estate with healthcare.

Why invest in Dobré časy?

- Investors become co-owners of not only the facility and the land, but also the entire group of companies responsible for operations.

- Stability of income and targeted higher returns based on ongoing income from the Czech healthcare system combined with income from private individuals and clients of the nursing home.

- Contracts with 4 insurance companies for the DLP and DZR service.

- Strongly growing segment with low supply and high demand, the so-called value-added real estate project.

- Expected investment appreciation of 15-20% per annum.

You can also read about the real estate fund CB Property Invsetors in the economic weekly TREND.SK