2022 has changed investor behaviour: they are more interested in local investment opportunities

21/06/2022

Instability in financial markets and the global economy, rising inflation and geopolitical developments are causing changes in investor behaviour. Support for popular Czech and Slovak companies and innovations has emerged as one of the main factors in their motivation to invest. This corresponds to recent developments on our investment platform. Especially in terms of the increase in the number of registrations and the total volume of investments in companies and real estate, which currently exceeds €40 million.

In our recent online survey¹, 40% of respondents said that localness – the possibility of investing in domestic investment opportunities, was one of the critical reasons for them to invest. In addition to asset appreciation (80%) followed by generating passive income (58%), preserving the value of spare funds, such as inflation protection, in particular, plays an essential role for most investors (52%) in these times.

"In critical times, investors are naturally more cautious and conservative. They are looking at long-term capital allocation to maintain the value and generate an attractive return. We see this trend among our investors as well, and one of the decisive parameters is localness - the interest to co-own a brand that I know, to participate in the development of infrastructure that will contribute to employment in our region, improve the availability of services, housing, etc.", says Peter Bečár, partner at Crowdberry, assessing the current development.

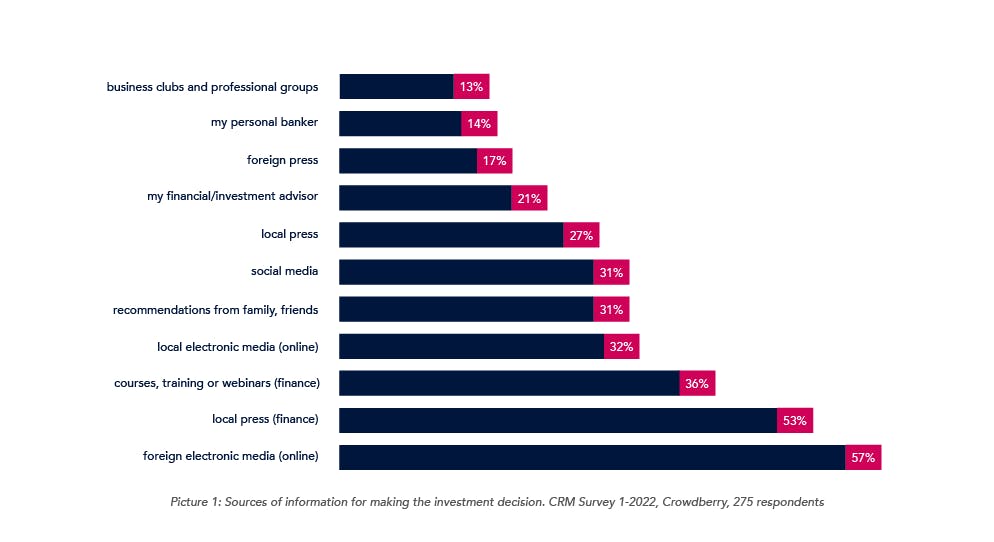

The decision to implement an investment plan is often a long-term process for investors. They often turn to foreign and domestic sources, especially economic media. They are also interested in various financially oriented webinars, training courses, and social networks.

"At Crowdberry, investors have access to investment documentation that includes detailed information about the company, the opportunity itself, the financial model, as well as detailed analysis from reputable sources about the market, competition and so on," says Peter Bečár. "Investors value the transparency of the process, and not only the reputation of the investment firm is important to them, but also the comprehensiveness of the information and access to the details of the investment opportunity."

Another critical factor investors address is the distribution of investment risk across multiple instruments and segments. Data from early 2022 shows that approximately 60% of respondents rely on index funds, while 57% rely on exchange-traded company stocks. This is followed by real estate (53%) and direct investments in companies (44%).

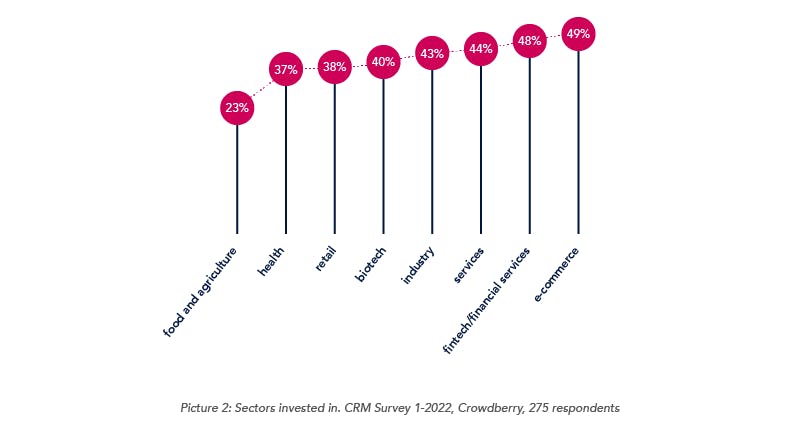

Regarding individual sectors, e-commerce was the most attractive for respondents (50%). Fintech and financial services were among the second-most-popular segment for respondents at 48%, followed by general services, industrials, and biotech (all areas around 40%).

Since the beginning of this year, Crowdberry investors have had the opportunity to invest in several investment opportunities (with 10 of them launched in the first half of 2022) with a total target capital of approximately €22 million. The volume of confirmed investments from active campaigns in the first half of this year represents a total capital value of over €8 million.

Become part of Crowdberry and invest in Czech and Slovak real estate and companies with huge potential.

¹ CRM survey, January 2022, Crowdberry (investors marked multiple options), anonymous online form, sample of 275 investors out of 3,500 respondents, 80% aged 35+, country: SK, CZ