Gutovka Residence in Prague

Diversify in the Prague real estate market: property in an attractive location with a secured 11% p.a. yield.

Invest in Czech crowns via a loan to the Gutovka Residence project in Prague and diversify your real estate portfolio in a strong market. Capital from Crowdberry investors will enable the developer to finance the purchase and conversion of a 1930s building into 26 modern residential units, 2 studios, and 6 retail units for sale. Expected sales proceeds total CZK 181 million. Investors receive a fixed return of 11% per year.

The building has a valid building permit, is already standing, and the reconstruction is in full swing, which significantly reduces investment risk.

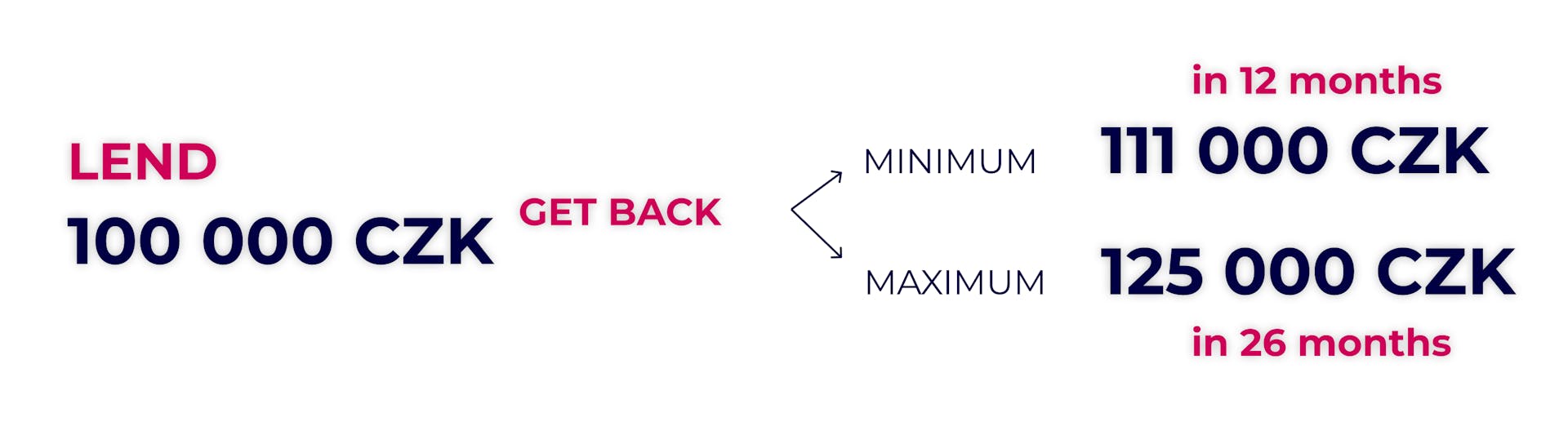

For the loan provided, you earn a fixed annual yield of 11%, paid together with principal at loan maturity. This is a short-term investment of 1 to 2 years with strong security: a notarial deed, a parent-company guarantee (the group has successfully completed more than 20 projects), and a lien on the property that takes effect after the bank loan is repaid.

The project’s Loan-to-Value (LTV) ratio is 63%, which means even a conservative financial scenario assumes smooth loan repayment. Sale prices would have to drop by more than 37% for investors not to recover their investment including interest.

The attractive location and sustained high demand for smaller investment apartments in Prague support a rapid sell-out of all units.

Why invest?

- Attractive 11% p.a. coupon - investors have a fixed return. Interest accrues and is paid together with the principal at loan maturity.

- Quick payback - a short loan term of 26 months with the option of early repayment after just 12 months. The reconstruction is scheduled for completion in August 2026, with apartment sales starting October 2025.

- Excellent connectivity - a Prague property just a few minutes’ walk from a metro station, with a tram stop directly in front of the building.

- Fast execution with no permitting or construction risk - the project is a reconstruction that will deliver smaller apartments, for which market demand is high.

- Experienced developer - the Czech company Real Luxembourg has successfully completed more than 22 similar development projects.

- Multi-layer security - the investment is protected by a notarial deed, a lien on the property (after the bank loan is repaid), and a parent-company guarantee. This combination of instruments significantly increases investor certainty.

Investment Opportunity

Invest from CZK 10,000 and grow your money: a secured, short-term real-estate investment in Prague with an attractive 11% p.a. return.

Loan amount: 20 - 25 million CZK

Minimum investment: 10,000 CZK

Interest yield: 11% p.a. (risk margin 7.5% + 3.5% PRIBOR; once 20% of the apartments are sold, the margin decreases to 6.5% p.a.)

Loan maturity (investment horizon): 12 - 26 months

Payment of interest and principal: at maturity

Default interest: in case of late interest payment, 1% per month (12% p.a.)

Loan security: notarial deed, parent-company guarantee, and a lien on the property once the bank loan is repaid.

About the developer

Real Luxembourg, s.r.o. is a Czech development company founded in 2016, focused on the renovation of Prague apartment buildings. To date, it has completed 30+ similar projects and is an active player in the Prague real estate market.

The developer is part of the Real Luxembourg SICAV group (a qualified investor fund). The group’s core activity is investing in Prague urban apartment buildings, leveraging deep knowledge of local demand and regulation. It also invests in commercial real estate and in agricultural and forest land across the Czech Republic, adding a long-term stable component to its residential portfolio.

Completed projects in Prague include Dům U Tyrše, Výhledy Podolí, Rezidence Jablonského, and Rezidence Velehradská 24. Based on the developer’s experience, most apartments in these projects sell within a few months of completion.

Risks

🟢 Project risk: low

Schedule or budget changes may occur during execution; however, these risks are mitigated by a fixed budget, a contracted general contractor, and loan security via a notarial deed and a lien.

🟢 Construction risk: low

This is not new construction but a renovation of an existing building, which significantly reduces risk. An experienced contractor is delivering the works, the project is insured, and a post-completion defects warranty will apply.

🟢 Financing risk: low

The project is financed through a combination of a bank loan, a mezzanine loan from Crowdberry, and the developer’s own equity. Total leverage (LTV) is around 60–70%, allowing ample capacity to service both bank and mezzanine debt including interest. After the bank loan is repaid, a lien in favor of Crowdberry investors will be placed on any unsold units.

🟡 Market risk: medium

The average planned unit sale price is CZK 5.6 million, which corresponds to roughly CZK 183,000 per m². Current prices in this part of Prague range between CZK 131,000 and CZK 185,000 per m². The project benefits from VAT exemption, giving the developer room to adjust prices if the market slows. The focus on smaller, more affordable units (1+kk and 2+kk) further supports liquidity even under less favorable market conditions.

Loan rating for the investment opportunity: C.

Details of the risk scoring and further information on risks can be found in the Financial Analysis, available after you express non-binding interest in investing.