Coronavirus is having a positive impact on some real estate segments

20/05/2021

Real estate is an ideal way to diversify one’s portfolio today. Capital invested in real estate brings not only interesting opportunities for appreciation, but also protection against inflation. How did industrial real estate, retail parks, residential development and construction of housing for seniors perform last year and why is capital distribution important? Find out in this next instalment of our Investing in Real Estate series.

Industrial real estate: e-commerce is the driving force

Demand on the part of e-commerce

The long-term growth trend in e-commerce has accelerated by roughly one to two years due to the pandemic. It is expected that e-commerce’s share of total retail sales in the Czech Republic could reach 29% compared with the current 16%. This is putting tremendous pressure on logistics properties and warehouses, as well as on related infrastructure and shipping/logistics companies. However, the Czech Republic is no exception among countries where e-commerce has grown and continues to grow. The most advanced e-commerce market is the United Kingdom, where the share of online purchases of total retail revenues reached 28% in 2020. Slovakia also registered record growth in revenues from online sales last year.

Property value

The value of properties in the context of logistics has shifted over the past year thanks to the inflow of capital from other sectors such as hotels, offices and shopping centres, as well as due to the lack of space resulting from the increased interest of e-shops. Investing in this segment is also interesting with respect to long-term lease agreements, the creditworthiness of tenants from the ranks of e-commerce entities, and rent levels, which are very stable and predictable.

Change of standards

Due to technological changes and ongoing automation, there is rising demand for infrastructure in the case of industrial real estate, and building standards, such as height, are changing. Initiatives aimed at achieving carbon neutrality and reducing the energy intensity of buildings are also increasingly important.

As a result, new subgroups of properties are emerging. One of the strongest is last-mile logistics and the establishment of small centres for delivering packages from e-shops. One such property on our platform is the investment in a logistics facility in Nitra.

We are preparing more information and statistics for you in an e-book. Sign up to receive the newsletter and we will let you know as soon as the e-book is ready.

Retail parks are emerging from the crisis stronger

Flexible use of retail parks

Retail parks have shown that the model of stores with their own entrance directly accessible from the parking lot can prosper even during a pandemic. In the future, the use of space in retail parks for e-shop pickup points will also be an important aspect, which, with respect to the expected growth mentioned above, means further potential for investments to grow. Long-term lease agreements and an interesting tenant base are also points in favour of retail parks.

Fast shopping

Retail parks have grown in popularity among shoppers for the past two years, primarily due to their specific layout, where each store has its own entrance. This allows customers to simply park in front of the given store, thus limiting contact with other visitors, which is a major advantage during a pandemic.

In response to this change, some retailers are also starting to favour retail parks over shopping centres. This is happening primarily due to lower costs, greater flexibility, better access to customers and resistance to the pandemic, as well as growing e-commerce.

Interesting risk/return ratio

The retail park segment in Slovakia has one of the highest returns – 7.3% (in comparison with other sectors such as logistics at 6.3% and offices at 6.0%) with a saturation level that remains low compared to Western Europe. While the population in the CEE region is about 43% that of Western Europe, we can find 88% of the floor area of all European retail parks in Western Europe.

In the coming years, investors can benefit from international investors’ stable interest in retail parks, as well as from the interest of retail chains that are expanding or moving out of shopping centres. If you are interested in how such a particular investment opportunity looks, take a look at KLM Piešťany.

Development projects with value added

Lack of places for seniors in specialised facilities

Investment opportunities can also be found in specialized construction projects. At Crowdberry, we recently focused on the Dúbravská oáza retirement home, which is a modern care centre for the elderly and seniors suffering from Alzheimer’s disease. For the first time ever in Europe, such a construction project was financed by private investors through a professional investment platform. Investors can enter into the investment at the preparatory stage and thus have the opportunity to participate in the profits derived from the construction project, but their investment also has a social aspect that addresses a long-term, society-wide problem – the ageing population. Dúbravská oáza is now again among the active investment opportunities.

We are preparing for you more detailed information on the development of the real-estate market in an e-book. Sign up to receive the newsletter and we will let you know as soon as the e-book is ready.

Residential construction – response to affordable mortgages

Substantial growth of property prices vs. declining rent levels

In the residential segment, there are currently interesting opportunities to get involved in construction projects together with developers due to the dynamics of the market. For developers, obtaining capital from private investors through the platform is becoming an interesting opportunity, as the prices of land intended for construction are rising and there are more opportunities for expansion, which requires additional capital. Therefore, we see a favourable opportunity to invest in construction where you have the possibility to participate in creating value alongside a professional partner and make a profit from the given construction property, co-own attractive land plots and benefit from rising property prices. This eliminates concerns associated with buying and managing properties, bank financing and leasing, which cost investors a lot of time.

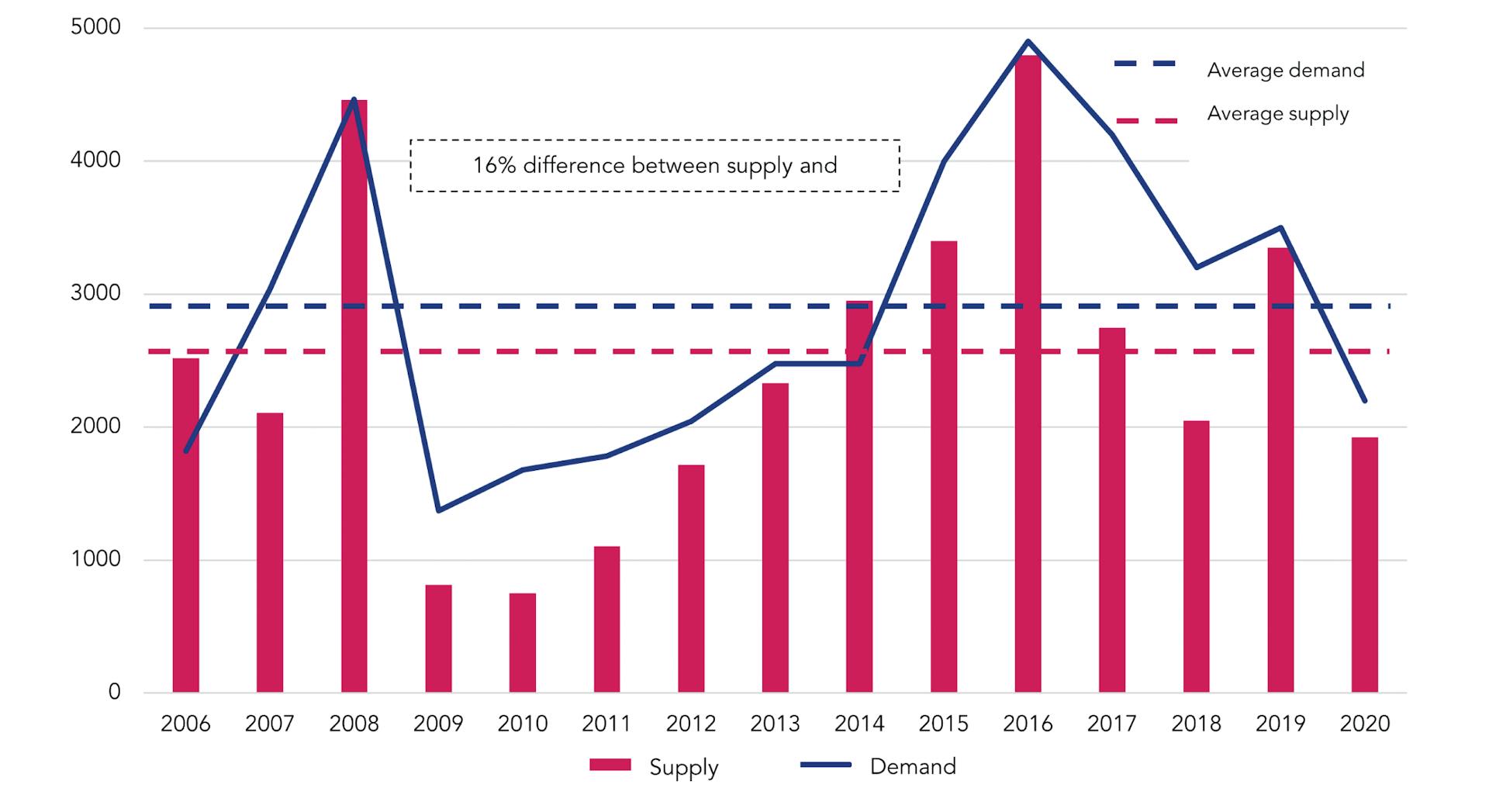

Demand outweighs supply

The supply of new apartments in Prague and Bratislava has long been insufficient. In combination with low mortgage interest rates in the Czech Republic and Slovakia, new construction is interesting for developers and thus also for investors.

More than 25 investors have joined together on the Crowdberry platform in an investment opportunity involving the construction of a building with 29 apartments in the greater centre of Bratislava, which reflects how demand for newly constructed residences outweighs supply. Smaller projects have a lower degree of risk for a number of reasons, including generally stronger interest in smaller-scale housing and greater ease of obtaining permits.

Development of supply and demand for apartments in newly constructed buildings in Bratislava.

Do you want to know more about trends in the real estate market and investment opportunities? We would like to invite you to a webinar organised by CBPI on 25 May 2021, which will be conducted by two of the top real estate experts in the Czech Republic – Peter Bečár and Omar Sattar.

Additional resources:

Direct investments in logistics and residential properties